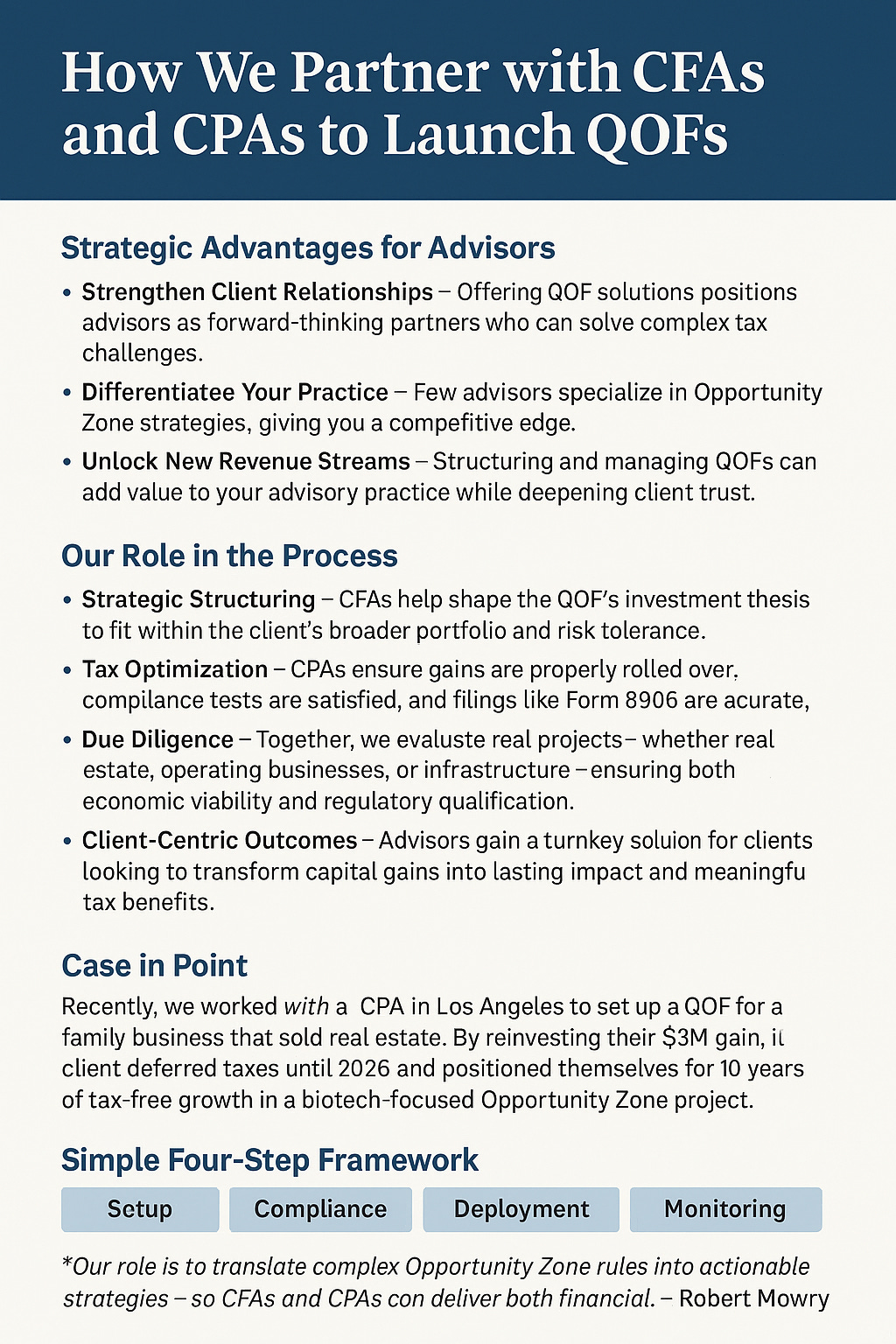

How We Partner with CFAs and CPAs to Launch QOFs

We collaborate closely with CFAs and CPAs to make Qualified Opportunity Fund (QOF) setup seamless and client-focused. By combining investment insight with tax expertise, we ensure each fund is IRS-compliant, strategically designed, and aligned with long-term wealth goals.

Strategic Advantages for Advisors

Strengthen Client Relationships – Offering QOF solutions positions advisors as forward-thinking partners who can solve complex tax challenges.

Differentiate Your Practice – Few advisors specialize in Opportunity Zone strategies, giving you a competitive edge.

Unlock New Revenue Streams – Structuring and managing QOFs can add value to your advisory practice while deepening client trust.

Our Role in the Process

Strategic Structuring – CFAs help shape the QOF’s investment thesis to fit within the client’s broader portfolio and risk tolerance.

Tax Optimization – CPAs ensure gains are properly rolled over, compliance tests are satisfied, and filings like Form 8996 are accurate.

Due Diligence – Together, we evaluate real projects—whether real estate, operating businesses, or infrastructure—ensuring both economic viability and regulatory qualification.

Client-Centric Outcomes – Advisors gain a turnkey solution for clients looking to transform capital gains into lasting impact and meaningful tax benefits.

Case in Point

Recently, we worked with a CPA in Los Angeles to set up a QOF for a family business that sold real estate. By reinvesting their $3M gain, the client deferred taxes until 2026 and positioned themselves for 10 years of tax-free growth in a biotech-focused Opportunity Zone project.

Simple Four-Step Framework

Setup – Entity formation and IRS self-certification.

Compliance – Ensuring the 90% asset test and timely filings.

Deployment – Directing capital into qualified projects.

Monitoring – Ongoing reporting and fund governance.

“Our role is to translate complex Opportunity Zone rules into actionable strategies—so CFAs and CPAs can deliver both financial performance and community impact for their clients.” — Robert Mowry, Partner

Looking Ahead

QOFs are not just about deferring taxes until 2026. They’re part of a broader movement toward impact investing, intergenerational wealth planning, and tax-advantaged portfolio management. By working together, we help advisors offer their clients a pathway to both meaningful economic impact and long-term financial efficiency.